Loading... Please wait...

Loading... Please wait...- Home

- Guru

-

MEGA List

- MEGA List Page

- Categories

- All Brands

- Trading Books

- AdvancedGET

- MetaStock

- MetaStock Add-ons

- MetaStock Plug-Ins

- MetaStock Utilities

- MetaTrader

- MetaTrader EA

- MetaTrader EA (Forex)

- NinjaTrader

- Statistical Analysis

- TradeStation

- TradeStation Add-Ons

- Trading Software

- Betting Exchange Software

- Mega Page - New Stuff

- Personal Development Courses

- More MEGA LIST

- More Courses_

- Books

- More Books

- Mega List #1

- Mega List #2

- Mega List #3

- Real Estate

- Course by Category #1

- Course by Category #2

- Course by Author #1

- Course by Author #2

- Course by Author #3

- Course by Author #4

- RosettaStone

- Mega Page - 0

- Mega Page - A

- Mega Page - B

- Mega Page - C

- Mega Page - D

- Mega Page - E

- Mega Page - F

- Mega Page - G

- Mega Page - H

- Mega Page - I

- Mega Page - J

- Mega Page - K

- Mega Page - L

- Mega Page - M

- Mega Page - N

- Mega Page - O

- Mega Page - P

- Mega Page - Q

- Mega Page - R

- Mega Page - S

- Mega Page - T

- Mega Page - U

- Mega Page - V

- Mega Page - W

- Mega Page - X

- Mega Page - Y

- Mega Page - Z

- MEGA CATALOG

- Search MEGA CATALOG

- Entire 3TB Hard Drive for DayTraders - For Sale $3K

- Entire 4TB Hard Drive for DayTraders – For Sale $4K

- BigBoss Hard Drive for DayTraders – For Sale $3K

- MONEY Catalog

- Some More Courses

- dvd

- estore

- libr

- shop

- store

- Portfolio

- BigBoss Hard Drive for DayTraders

- Latest Database

- FAQ

- Info

-

Market Summary

- Corona Virus Stocks

- FREE IBD WEEKLY

- FREE STOCK CHARTS

- Market.Summary

- IBD 50

- DOW 30

- NASDAQ 100

- CNBC IQ 100

- IBD Sector Leaders

- IBD Stock Spotlight

- IBD Big Cap 20

- IBD CANSLIM Select

- IBD Global Leaders

- IBD IPO Leaders

- IBD New Highs

- IBD Rising Profit Estimates

- IBD Relative Strength At New High

- IBD Stocks That Big Mutual Funds Are Buying

- IBD Weekly Review

- IBD Stocks On The Move Up

- IBD Stocks On The Move Down

- Zacks Rank #1 Strong Buys

- Zacks Rank #5 Strong Sells

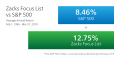

- Zacks Focus

- SPDR XLB Basic Materials

- SPDR XLC Communication Services

- SPDR XLE Energy

- SPDR XLF Financial

- SPDR XLI Industrials

- SPDR XLK Technology

- SPDR XLP Consumer Staples

- SPDR XLRE Real Estate

- SPDR XLU Utilities

- SPDR XLV Healthcare

- SPDR XLY Consumer Discretionary Goods

- Direxion Leveraged & Inverse ETFs

- IBD Innovator ETFs

- Technology ETFs

- Select Sector SPDR ETFs

- MARKET_SUMMARY

- 52 Week High Stocks

- 52 Week Low Stocks

- AGFiQ ETFs

- Airline Stocks

- Barron Stock Picks

- Bond ETFs

- IBD CANSLIM Grand Slam

- Casinos Gaming Stocks

- Commodity ETFs

- Equity ETFs

- ETF Investor

- First Trust ETFs

- Four Horsemen

- Home Run Investor

- IBD Breakout Opportunities ETF

- IBD Breakout Stocks

- IBD Dividend Leaders

- IBD ETF Leaders

- IBD Income Investor

- IBD REIT Leaders

- IBD Tech Leaders

- IBD Utility Leaders

- Income Investor

- International ETFs

- Invesco ETFs

- iShares ETFs

- JPMorgan ETFs

- Large Cap ETFs

- Marijuana Stocks

- Mid Cap ETFs

- ProShares ETFs

- REITs

- Sector ETFs

- Small Cap ETFs

- SPDR State Street Global Advisors ETFs

- Stocks at All Time Highs

- Stocks at All Time Lows

- Stocks Under $10

- Top 80 Technology ETFs

- Travel Hotel Stocks

- US Small Cap ETFs

- USAA ETFs

- Value Investor

- Warren Buffett Berkshire Hathaway Portfolio

- WisdomTree ETFs

- Zacks Top 10 Stocks

- Market Summary 2

- Publicly Traded Advertising and Marketing Stocks

- Publicly Traded Aerospace & Defense Stocks

- Publicly Traded Agricultural Stocks

- Publicly Traded Aviation Stocks

- Publicly Traded Biotech Stocks

- Publicly Traded Building Product and Materials Stocks

- Publicly Traded Business Service Stocks

- Publicly Traded Chemical Stocks

- Publicly Traded Clean Energy Stocks

- Publicly Traded Clothing and Footwear Stocks

- Publicly Traded Construction Stocks

- Publicly Traded Consumer Goods Stocks

- Publicly Traded Consumer Service Stocks

- Publicly Traded Cyber Security Stocks

- Publicly Traded Education and Training Stocks

- Publicly Traded Energy Stocks

- Publicly Traded Entertainment Stocks

- Publicly Traded Environmental Services Stocks

- Publicly Traded Financial Sector Stocks

- Publicly Traded Food and Beverage Stocks

- Publicly Traded Game and Hobby Stocks

- Publicly Traded Health and Fitness Stocks

- Publicly Traded Healthcare Facilities Stocks

- Publicly Traded Healthcare Stocks

- Publicly Traded Home Furnishing and Improvement Stocks

- Publicly Traded Industrial Stocks

- Publicly Traded Insurance Stocks

- Publicly Traded Internet Stocks

- Publicly Traded Materials Sector Stocks

- Publicly Traded Media Stocks

- Publicly Traded Medical Device and Equipment Stocks

- Publicly Traded Metal and Mining Stocks

- Publicly Traded Motor Vehicle Stocks

- Publicly Traded Multi Sector Stocks

- Publicly Traded Office Equipment and Supply Stocks

- Publicly Traded Pharmaceutical Stocks

- Publicly Traded Real Estate Stocks

- Publicly Traded Regional Major and Foreign Bank Stocks

- Publicly Traded REITs Stocks

- Publicly Traded Restaurants Stocks

- Publicly Traded Retail Stocks

- Publicly Traded Semiconductor Stocks

- Publicly Traded Shipping Stocks

- Publicly Traded Sin Stocks

- Publicly Traded Software Stocks

- Publicly Traded Sports Stocks

- Publicly Traded Technology Stocks

- Publicly Traded Telecommunications and Communications Stocks

- Publicly Traded Transportation Stocks

- Publicly Traded Travel and Tourism Stocks

- Publicly Traded Utilities Stocks

- SPDR Corporate & Government Bonds ETFs

- SPDR International ETFs

- Top 97 International Equity ETFs

- Portfolios

- Stock Charts

- MEGA VAULT

- Stream Movies

Categories

- Home

- MORE Courses

- Chris Rowe - Internal Strength System - 8 DVDs + 535 pages manual

Product Description

Chris Rowe, the Wall Street prodigy who has led many of you to profits of 50.46% ... 123.71% ... and 646.00%, shocks the world by announcing --

“I Quit!”

5 years ago, Chris Rowe turned his back on a Wall Street career worth tens of millions of dollars.

In 5 years from now he plans on doing it again. Only this time, you'll have the confidence to walk into your boss's office and join him.

Dear Investor:

“I quit.”

Five letters ... two simple words.

But as soon as I said them, I knew my life had changed forever.

The year was 1998. I was making so much money in the markets I had become a millionaire while still in my 20's.

And yet, I still quit. I'll never forget the look on my boss's face. He was shocked. He didn't understand (and still doesn't to this day) how I could so easily turn my back on tens of millions of dollars in future income.

But I was leaving for a reason. I was sick and tired of watching the Wall Street "establishment" lie, cheat and steal just to make a buck off the backs of hard working Americans.

That may sound like a cliche, but it's the honest-to-goodness truth. It was the nature of the "game" on Wall Street, and I had decided that I wanted no part of it.

So I took what I had learned directly from the richest and most successful investors on earth -- the secrets of how money is REALLY made in the markets -- and put it to work to help my readers profit along with the big players.

If you are one of my Trend Rider members, you already know the results: over the past few years, nearly 8 out of every 10 trades we've made have fattened our portfolios with handsome profits.

For example:

- We bet that troubled Wall Street giant Bear Sterns would stumble and fall -- and subscribers who followed my recommendations made a fast 123.01% gain -- more than doubling their money in just 5 weeks.

- On Piper Jaffray, we earned an easy 20.19% return in 24 hours -- equal to an annualized gain of 7,369.35%.

- Orbital Sciences returned a quick 32.19% gain in 5 weeks -- more than 5X the total return of the S&P 500 for the entire year.

But now I have another major announcement to make ...

In 5 Years from Today I Plan to "Quit" Again...

But This Time I Want YOU to Join Me!

As you can imagine, researching and writing The Trend Rider is a lot of work.

And lately, I've started to think about slowing down, taking it easy, and enjoying my money.

Yes, I'm only 30. So you may think it's absurd for me to even consider something like "retirement" at such a young age.

But when you have tragedy early in life, you see things differently.

When I was 15 years old, a doctor walked into my hospital room and told me I would never walk again.

My father, seeing that his son was never going to be able to play varsity sports, dance at the prom, let alone walk again, wanted to give me a happy and active life.

He told me that the stock market was the best gig in town for people with the time and patience to really study it. And as a disabled teenager, time was something I had plenty of.

While others were dating and hanging out at the school-yard, I was poring over price charts, reading every book on trading I could lay my hands on, and making successful paper trades.

A business associate of my father's saw my raw ability, and offered me a job at a Wall Street brokerage on the spot.

Soon after, the richest and most successful trader at the firm, Wall Street legend Mark Rosenberg, took me under his wing as his first and only apprentice.

The next 5 years under his tutelage were grueling and painful. Many good days and bad days.

But I persisted, and my persistence paid off: I learned to master the markets ... and make vast sums of money for me, my firm, and our clients ... at an age where most of my contemporaries and co-workers were getting drunk on weekends or going to Pearl Jam concerts.

Of course, I also lost many years of "normal" living that most young people enjoy. And now that I am financially independent, I'm thinking of making up for lost time.

Yet I don't ever want to leave you ... and so many other individual investors ... at the mercy of boiler-room operators, high-pressure stock brokers, hype-filled stock sales brochures (er, I mean "analyst reports"), and the other sharks on Wall Street.

That's why I decided to put down everything I've learned about beating the Street in the most comprehensive home-study investing education course ever created.

It's because I know from hard-earned experience that ...

The Only Way to Get Rich on Wall Street is to Have Information Nobody Else Has.

Truer words have never been spoken.

That's why I can say with confidence that no "civilian" has ever had access to an investing course as powerful as this one.

It was handed down to me by one of the richest men on the planet and has taken me almost fifteen years of my life to master and perfect.

Everything I've learned is all in here, and will be revealed to the first 250 people today who decide they want to declare their financial independence!

That's why I've worked evenings and weekends, for almost a year, writing the CRISS book, testing it out by privately tutoring a few of my subscribers, recording my lessons on DVD, explaining it all as clearly and as simply as I can.

And now I can say with confidence that the CRISS system has achieved both of the goals I set out to achieve when I started it:

1. IT'S A COMPLETE A-Z "NO-HOLDS BARRED" INVESTING "SYSTEM":

First, the program actually teaches you the exact methods I use to beat the market, with nearly 8 out of 10 trades being winners. Not a simplified, "dumbed-down" version that approximates my process. But the actual, step-by-step methodology I use here every day at Tycoon to make our readers money.

2. IT'S AS EASY TO MASTER AS WATCHING A MOVIE:

Second, I had to present the information in a way that even a novice trader or investor could easily understand ... and not just understand, but actually put into practice in his or her investing or trading. Fortunately, I've been told I have a gift for writing about investing and trading in a clear manner my readers find both educational and entertaining (see comments at left). So with a lot of hard work and effort, I've achieved that level of clarity in our course.

But our real goal was to make it as easy to learn as watching a movie. That's the only way we could ensure that what I teach you can be put to use right away to make outsized profits.

That's why we got so lucky when Hollywood producer/director Rene Besson -- who happens to also be a Tycoon Report reader and Trend Rider member -- offered to take on the project of producing the video part of the CRISS course. Thanks to his experience and talents, we were able to boil down all of my investing knowledge into about 10 hours of video content on 8 DVDs ... and, more importantly, 10 hours of instruction that you can start acting on right away.

Powerful knowledge in an easy-to-understand format ... that's why I'm so convinced that you'll have the confidence to walk into your boss's office one day soon and say “I QUIT” alongside me!

Tested, Proven and Fine-Tuned -- This System Really Works!

Of course, anyone can claim they have a "system" to beat the market, and make it sound good.

But my system's results are published every week for my Trend Rider members, and are displayed online in real-time in The Trend Rider Model Portfolio.

So I can't "fake it" when discussing my track record. It's public knowledge, easily available to any of my members with a PC and an Internet connection.

Fortunately, I have nothing to hide. Most mutual fund managers under-perform the broad markets, and most financial advisors cherry-pick their track records. They show you only the handful of winners, conveniently "forgetting" to mention that most of their stocks lose money.

But nearly 8 out of 10 trades selected by the CRISS method make money for my members, and these results speak for themselves.

Including:

* Merrill Lynch -- up 71.71%.

* Apple Computer -- up 34.72%.

* Nike Inc. -- up 48.00%.

* Phelps Dodge -- up 63.8%.

* NMT Medical -- up 89.74%.

* Vignette -- up 100%.

* Citrix -- up 74%.

* Valero Energy -- up 59.75%.

* Inco Ltd. -- up 60.25%.

* Marvel Technology -- up 42.73%.

* Murphy Oil -- up 22.75%.

* Newmont Mining -- up 98.2%.

* SPSS -- up 27.28%.

* Corn Products -- up 64.00%.

* NMT Medical -- up 89.74%.

* ExxonMobil -- up 30.13%.

* Bear Sterns -- up 123.01%.

* EMC -- up 35.29%.

* Oregon Steel -- up 48.4%.

* Hologic Inc. -- up 30.13%.

* iShares -- up 59.02%.

* Dow Chemical -- up 61.9%.

* American Oriental Bioengineering -- up 46.67%.

* Orbital Sciences -- up 32.19%.

* Seabridge -- up 74.07%.

* Energy Select Fund -- up 51.73%.

* F5 Networks -- up 38.69%.

The bottom line: Chris Rowe's Internal Strength System makes money -- a lot of money -- for my readers.

When is it best for you to invest?

To outperform the market, you have to master all the factors that determine when a company's shares are most likely to rise, not just some of them. It is the combination of indicators, each reinforcing the other, that gives us the most accurate barometer of when and where to invest our money.

One of the topics I cover in detail in the CRISS course is timing or seasonality -- the best months and years to make investments in specific markets. Many investors are unaware of facts like these:

- In the 4-year presidential election cycle, market strength is greatest in the pre-election year: the NASDAQ has posted an average 32% gain since 1971 in pre-election years -- and the Dow hasn't had a losing pre-election year since 1939.

- Since 1991, October has been the strongest month for the Dow and the S&P 500.

- For the NASDAQ, the best months are October through January, during which the NASDAQ has averaged 12% four-month returns for over a decade.

A Tale of "Two Markets"

Individually, the vast majority of "market forecasting systems" and "trading systems" on the market today have limited usefulness -- something you likely know from first-hand experience.

Most are -- to put it mildly -- inaccurate. Worse, those financial advisors who are occasionally correct in predicting broad market trends don't help you profit from them -- because when it comes to finding individual stocks to capitalize on those trends, they haven't a clue.

On the other end of the spectrum, there are many technical trading systems out there. And some of their charting techniques are quite useful for finding bottoms and tops.

But the problem is, they don't tell you where to focus your attention. You gain some charting techniques to help you time trades. But they don't tell you which markets, sectors, or stocks to look at.

Chris Rowe's Internal Strength System combines the best of both worlds, and the flaws of neither.

First, I'm going to help you understand that there are, in fact, two stock markets out there ...

One is the external market, the market that most investors see day in and day out. That's the stock market that most people use to tell them what already happened. It's also the stock market that is responsible for most investors losing money on the vast majority of their trades.

But right beneath the surface of the external market is what I call the "internal market," and that's the market you need to understand to get very rich -- in a very short period of time -- as an investor.

For example ...

Just recently (October, 2007 to be exact), the external market was running and gunning. The S&P 500 reached a high of over 1,565 ... the DOW had broken 14,000 and was heading higher. Everything was positive, and individual investors were pouring more and more money into stocks.

But behind the scenes, it was a different story altogether. My breadth indicators (which you'll learn in detail) were flashing one warning sign after another that the internal market (the REAL stock market) was showing serious signs of weakening.

What did I do? As Trend Rider members know, I pulled the trigger on numerous bearish trades, on the weakest stocks I could find, in the weakest sectors ... the ones that would give us the absolute most profits when the market really and truly fell apart.

Just as I expected, the S&P 500 lost more than 3% over the course of two weeks. During that same time period, while most investors were seeing red, our positions were up 13%, 26%, 25% and 47%.

The point here is that I knew it was coming. It wasn't magic, and it wasn't a lucky guess. The internal market LEADS the external market, and understanding what's going on below the surface can give you the closest thing to a crystal ball as you'll ever find.

And you'll learn how to do exactly what I did ... in just the first section of the CRISS course!

The Power to Unlock Wall Street's "Hidden Logic"

If you think Wall Street is a crapshoot and that the market is completely random and can't be "read" then you'll be blown away at what you discover when you begin watching the CRISS DVDs.

The course was designed to shatter your preconceived notions and take your investing skills -- and profits -- to an entirely new level.

Here's a brief outline of the 4 main sections of my Internal Strength System, and how you'll be able to invest with confidence after taking the course ...

ISS Section #1: You'll Discover The Direction of the Market -- Before the Rest of the World Finds Out -- in Our Trend And Condition Section!

Have you ever found yourself wondering why the market has been moving higher or lower? No more!

With CRISS you'll gain a true understanding of the direction of the market, allowing you to know whether you should be bullish or bearish.

You'd think every financial professional and investor would know how to accurately determine market strength. But you'd be wrong if you believed that.

Turn on the TV and the radio, and what's the main financial news of the day? It's whether the Dow is up or down, and how many points it rose or fell.

The Dow Jones is what the "Joe Investor" uses to identify the market's trend and risk. But it's a highly inaccurate indicator. Not only is the Dow Jones average disproportionately price weighted ... but it is based on only 30 stocks!

You could turn to the S&P 500 to get a clearer picture of the market's internal strength. But again, watch out.

The S&P 500 is based on 500 stocks, not 30. But the biggest 50 stocks make up half the weight -- and contribute to half the index's movement. So tracking the S&P 500 doesn't give you a fair picture of where the market is heading, either.

In the CRISS course, I reveal the only way I know of to truly gauge the market's inner strength, direction, and risk ... and believe me, it has nothing to do with watching the Dow or S&P 500.

ISS Section #2: You'll Always Know Which Sectors to Invest in -- And Why -- When You Study the Relative Strength Section!

Once you discover the direction of the overall market, it's not good enough just to put your money in stocks or take it out. To make the absolute most money possible, you need to know which sectors are strongest (and weakest), so you can squeeze every last dollar in profits out of the market's move, whether it's up or down.

Let me explain ...

Many people don't even understand that sectors act like mini "stock markets" within the broad market. Some sectors move in tandem. Others move in opposition.

For instance, you can see here that the leisure sector was moving down during the exact same time period as the oil sector was moving up.

Oil stocks rise...

...while leisure stocks fall.

Also notice that some sectors can be much more volatile than others. Look at how the oil stocks moved like a roller coaster while leisure stocks moved up and down rather, well, leisurely.

In the CRISS course, I show you EXACTLY how to calculate the relative strength of the 10 broad stock market sectors, 50 more specialized stock market sectors, and countless other subsectors. Being able to narrow down your opportunities will be easy, and will greatly increase your odds of trading in the strongest bull markets (and the weakest bear markets, if you'd like to double your profit opportunities).

Utilities ... tech stocks ... oil and gas ... biotechnology ... health care ... consumer products ... gold and precious metals ... manufacturing ... all market sectors are inter-related in ways the average investor doesn't understand -- but you will, once you complete this section of the CRISS home-study course.

ISS Section #3: You'll Discover Which Individual Companies to Trade -- and EXACTLY When to Get In and Out -- in the Charting Section!

Ultimately, the most valuable indicator of where a stock is going is price.

Everything the market knows about the stock -- revenue growth, P/E, book value, net current assets, earnings per share -- is reflected in the price, which is the value the market assigns to the stock at the moment.

That's where my proprietary combination of charting techniques can help you find stocks whose share prices are likely to climb ... and time entry and exit points for both stock and option trades.

With charting, we look at price movements in our stocks over short periods of time: days, hours, even minutes.

Here is where momentum comes into play. You've heard traders say, "The trend is your friend." In the CRISS Course, you'll discover EXACTLY HOW to spot chart formations that indicate a stock is about to break out of a pattern ... and move much higher, or much lower.

Take a look at this chart of the NASDAQ Composite. I made insane amounts of money for myself and my clients during this uptrend … but I did it by knowing exactly when to get in and when to get out. The red arrows indicate points where my indicators signaled an upcoming downward move, and the green arrows point to times when I knew a breakout was about to occur. In the CRISS course, you’ll learn scores of indicators and chart patterns that will give you the ability to buy and sell at the best prices possible for maximum profits.

ISS Key #4: Money Management ...

In these lessons, I show you how to maximize your trading profits and manage your investments for greater safety and higher gain.

You'll discover:

- How to profit from both the bull side and bear sides of the market ...

- The best places on the Web to pick stocks ...

- How to flip the risk/reward ratio of investing in your favor ...

- How to use options contracts to leverage your investments and mitigate your downside risk ...

- How to collect monthly income on all your stock positions -- even those not paying a dividend ...

- How to always be on the right side of the market ...

Multiply Your Profits Up To 20X Or More!

All the opportunities you uncover using the CRISS system can be traded either as straight stock or ETF purchases, or by using options contracts. It's entirely up to you.

Some of my readers just don't want to bother learning options, and with the CRISS track record, you can trounce the broad markets with my system, just buying and selling shares of common stock or ETFs.

On the other hand, if you take the time to master my easy options trading methods, you can greatly leverage your investment while reducing your downside risk.

Let's see how leverage works. An option contract allows you to control a large amount of an asset -- bushels of soybeans, ounces of gold, or shares of a stock -- for a small up-front price called the "premium."

The leverage -- the ratio of the value of the assets you are controlling vs. the small premium you pay to control them -- can be as high as 20 to 1 or greater.

Example: say Company X is selling for $100 a share. To buy 200 shares outright would cost you $20,000.

Instead, we buy an options contract to control 200 shares of the stock for only $1,000 -- giving us leverage of 20 to 1 on our investment.

Say the share price goes to $150. Your 200 shares are now worth $30,000, giving you a profit of $10,000.

Had you bought the stock with cash, you would have invested $20,000 to make a $10,000 profit, giving you a 50% gain on the investment.

But the options trader who paid a $1,000 premium also made nearly $10,000 in profit, which is a 900% gain on his $1,000 investment -- 18 times the return earned with a straight stock trade.

Now, let's say Company X got de-listed from the exchange and its shares became worthless.

The stock would be worthless, and you would have lost your entire $20,000 investment.

The options trader, on the other hand, would have lost only the $1,000 he paid for the contract premium.

Trading options is not at all complicated. It scares a lot of people. But it shouldn't.

In my CRISS program, I remove the intimidation factor and show you where to find the right options, how to calculate your risk/reward ratio, and exactly what you need to do to get started -- whether you're an experienced chart reader or have never traded anything more than a mutual fund in your life.

If You Can Master These 3 Easy Rules, You Can Master the CRISS System

You're going to learn more from this course than you've ever learned about investing from any other source in your life, period.

But your success -- once you've gone through all the DVDs, read the book, and taken advantage of all the resources on the members-only website -- depends largely on your willingness to accept the "3 golden rules" of CRISS investing:

1. ALWAYS TAKE A SYNERGISTIC APPROACH

The whole is greater than the sum of its parts.

You're going to learn some incredibly accurate tools in this course that have the power to tell you what's most likely to happen next in a stock, an index, or sector.

But the key is to maximize your chances of being right, and that means that when one of the indicators you'll learn tells you to BUY, BUY, BUY (or SELL, SELL, SELL), it's imperative that you look for one or more other indicators to confirm the signal.

The good news? When you're done with this course, you'll know more indicators than most professional investors, and you'll have them down cold.

Think about the way a doctor diagnoses a mysterious health problem. The doctor evaluates the patient's symptoms one at a time, and, based on several different clues, comes up with a diagnosis.

Any doctor who treats an unusual health problem based on one single clue is likely to recommend the wrong treatment. On the flip side, the doctor increases the odds of a correct diagnosis with each clue, symptom or indicator. Since health is such a serious matter, doctors have to take this synergistic approach to patient evaluation.

Your health is more important than your wealth, but your wealth is also a very serious matter.

Just as a doctor increases the odds of a successful treatment by using several different clues, you can tremendously increase the odds of a successful trade by using one indicator to confirm what another is telling you. And the luxury that you have when diagnosing a stock, which the doctor doesn't have, is the choice to walk away from a situation if the clues don't add up.

2. CASH IS A TRADE, TOO

You must have the discipline to know when to stay out! For most people, this is one of the easiest concepts to grasp, yet the hardest to follow.

I would estimate that 99% of individual investors don't spend enough time on the sidelines. Keep your standards high, and be willing to sit on the sidelines for as long as you have to.

Savvy investors are willing to sit in a risk-free interest bearing account for years if they have to, and you should get comfortable with taking the same stance. What's likely tied for first place on the individual investor's list of most common mistakes is the notion that if you're not in the market you're not making money. Anxious and over-eager investors force trades at the wrong time, mainly because they're afraid of missing the next big gain.

3. TUNE OUT THE NOISE

You're a human being, and human nature is a very hard thing to fight. And that's what the stock market's all about. That's what separates the person on the winning side of the trade from the person on the losing side of the trade.

Once you learn about human nature, you'll find that humans are very predictable. With this knowledge we (the minority) take advantage of the actions of the majority (most individual investors -- and even a large number of professionals).

Winning traders aren't always the most intelligent people. (Look at me.) Oftentimes, they are just the people who know how to control their emotions while most can't.

The media are professionals at controlling the masses. That's what they do. But you can use them to your advantage if you can learn to tune them out and draw your own conclusions from raw data instead of considering other peoples' opinions. You can make money in the market by taking advantage of the masses' emotion-based actions.

You've probably heard statistics like: "10% of the country's population controls 75% of the country's wealth." That's because most people are like sheep. And I'm going to teach you to profit from that.

Give Me Just 60 Minutes a Week ... and I Promise to Create a Financial Miracle in Your Life!

Remember, I created the CRISS course with one single purpose in mind: to enable you to trade my proven system independently, without my guidance or recommendations.

That way, you can continue to profit from my approach - when I decide to finally "hang it up" and retire.

As a result, the CRISS course isn't a summary of my analytical tools and methods. It's not a selected few of the tricks and techniques I use. It's my ENTIRE SYSTEM ... everything you need to read the markets and make the same trades I do.

Your CRISS course materials include:

The CRISS Video Series ... approximately 10 hours of lessons, each covering a different aspect of my system, on professionally mastered DVDs. Each DVD session is like having me come into your living room, and in just 60 minutes, I teach you what you need to know to consistently bank profits on winning trades, just like I do every month in The Trend Rider. Value: $3,997.

This course contain 8 DVDs and 535 Pages PDF Manual.