I recently watched a video by Scott Landers which described a method by which he uses volume to determine significant areas of support / resistance on intra-day charts. His method seemed like it could be a useful tool to add to my intra-day trading strategy, so I wrote some code for it.

I recommend watching the video to get a better idea of what this ThinkScript is designed to do. The short version is that volume is an important indicator of market sentimentality and may be used as a tool to determine potential areas of support and resistance.

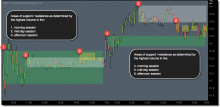

The trading day is divided into three sessions: morning (0930 – 1100), mid-day (1100 – 1400), and afternoon (1400 – 1600). The highest 5-minute volume in each session defines the greatest area of market interest and will show areas of significant support / resistance.

This indicator will work on 5 minute charts or below. The green boxes show the major areas from the morning session; gray boxes are from the mid-day session; and yellow boxes are from the late-afternoon session. The gray lines show the major support / resistance areas from the previous day.

The session colors may be adjusted from within the “Globals” section of the script settings panel.

The extension lines showing the areas of support / resistance from the prior day’s trading session may be enabled or disabled from within the script settings pane as well.

Additionally, I wrote a script that color codes the highest volume bars that correspond with each intra-day trading session.

Once again, the colors may be adjusted from within the script settings pane.

Loading... Please wait...

Loading... Please wait...